“`html

U.S. Senators Unveil Bill to Prevent Easing of Curbs on Nvidia Chip Sales to China

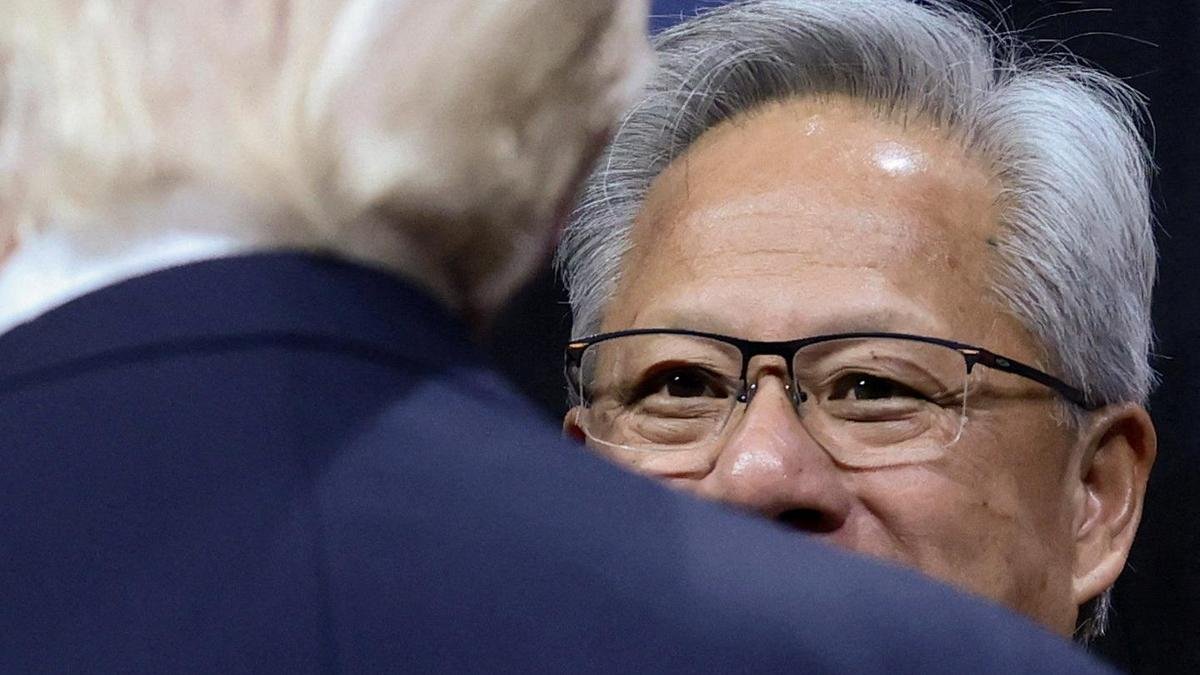

In a move reflecting growing concerns over national security and global technology dominance, a bipartisan group of U.S. senators has introduced a bill aimed at preventing the Trump administration from loosening restrictions on the sale of cutting-edge artificial intelligence chips by Nvidia and AMD to China. These restrictions have been a critical part of keeping advanced technological capabilities out of the hands of potential military adversaries, maintaining the U.S.’s leadership in AI development.

Background and Context

The semiconductor industry is a cornerstone of modern innovation, powering everything from smartphones to sophisticated weaponry. Within this sector, the high-powered chips designed by companies like Nvidia play a crucial role in AI applications, data centers, and more.

According to TechCrunch, these chips have wide applications across various industries, including some with significant national security implications. This new legislative measure comes amid fears that China could use advanced AI technologies to leap ahead in fields like cyber warfare and state surveillance.

The Legislative Proposal

The proposed bill is set to forestall any easing of current restrictions for up to 2.5 years. The initiative is garnering support as lawmakers emphasize the necessity of stringent export controls to curb China’s technological ascent. “It’s a matter of national security,” stated one senator during the announcement, highlighting the bipartisan nature of the bill.

Implications for Nvidia and AMD

Nvidia and AMD are among the most prominent U.S. companies affected by these restrictions. Nvidia, which produces some of the world’s most advanced AI chips, has seen its stock fluctuate with news of potential regulatory changes. As reported by The Verge, Nvidia’s revenue from China accounts for a significant portion of its international sales portfolio.

| Company | Market Share | Key Markets |

|---|---|---|

| Nvidia | 21% | USA, China, EU |

| AMD | 16% | USA, China, Japan |

Industry Opinions

The tech community is closely watching the developments. Industry experts are divided on the long-term impact of these restrictions. Some argue that restricting chip sales might slow innovation, as companies like Nvidia are unable to maximize their R&D budgets without the revenue from China. Others believe that these measures are necessary to maintain a strategic advantage.

According to a Gizmodo report, industry analysts suggest that Nvidia and AMD might look to diversify their market presence, seeking new opportunities in emerging tech hubs outside of China.

Global Technology Landscape

With the rise of AI, the geopolitical landscape is shifting. U.S. lawmakers are increasingly concerned about China’s ambitions in AI and quantum computing, areas where semiconductors play a pivotal role. The U.S. aims to keep its competitive edge while balancing economic relationships.

Efforts such as the newly proposed bill highlight a broader strategy to harness technological strengths while guarding against strategic vulnerabilities.

Conclusion

This legislative proposal is emblematic of a larger global trend: the intertwining of technology policy and geopolitical strategy. As China continues to invest heavily in its technological capabilities, the U.S. is taking steps to ensure its leadership in AI remains unchallenged.

As the bill moves forward, it will be crucial for tech companies and policymakers to engage in a dialogue that considers both innovation and national security. The tech community should remain vigilant, advocating for policies that foster growth while safeguarding strategic interests.

Related Reading

- iPhone Air designer Abidur Chowdhury leaves Apple just months after launch, looks towards future in AI

- AI likely to be used to organise and undermine next general election, committee hears

- AMD, Cisco, and Saudi’s Humain launch AI joint venture, land first major customer

“`